.

.

The foreign exchange market is not easy to manipulate.

But it is still possible for traders to change the value of a currency in order to make a profit.

As it is a 24-hour market, it is not easy to see how much the market is worth on a given day.

Institutions find it useful to take a snapshot of how much is being bought and sold. Until February, this happened every day in the 30 seconds before and after 16:00 in London and the result is known as the 4pm fix, or just the fix.

Since these violations came to light, the window has been changed to five minutes to make it harder to manipulate.

The fix is very important, as it is the peg on which many other financial markets depend.

So how do you make currency prices change in the way you want?

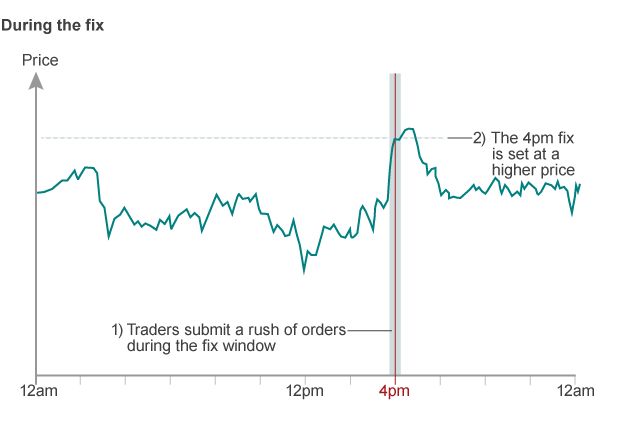

Traders can affect market prices by submitting a rush of orders during the window when the fix is set.

This can skew the market’s impression of supply and demand, so changing the price.

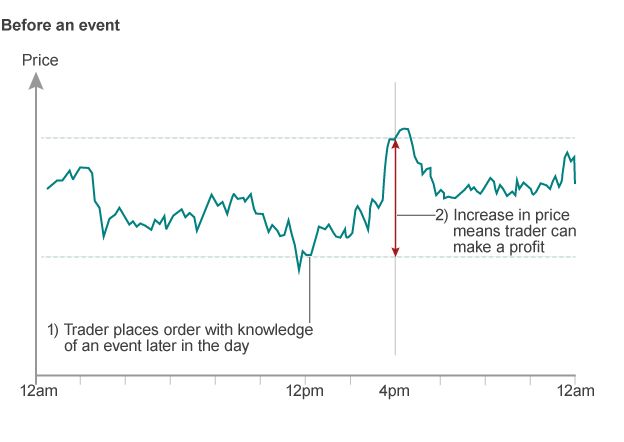

This might be where traders obtain confidential information about something that is about to happen and could change prices. For example, some traders shared internal information about their clients’ orders and trading positions.

The traders could then place their own orders or sales in order to profit from the subsequent movement in prices.

This can relate to the 4pm fix, with a trader placing a trade before 4pm because he knows something will happen at around 4pm.

.gif)

It is easier to move prices if several market participants work together.

By agreeing to place orders at a certain time or sharing confidential information, it is possible to move prices more sharply.

That could result in traders making more profits.

Collusion can be “active”, with traders speaking to each other on the phone or on internet chatrooms. It can also be “implicit”, where traders don’t need to speak to each other but are still aware of what other people in the market are planning to do.

‘Hooray nice teamwork’

Last November, the UK’s financial watchdog, the Financial Conduct Authority (FCA) gave some examples of how traders at banks calling themselves names such as “the players”, “the 3 musketeers”, “1 team, 1 dream” and “the A-team” attempted to manipulate foreign exchange markets.

In one example, it said traders at HSBC had colluded with traders from at least three other firms to attempt to drive the fix for the sterling-dollar rate lower.

It said traders had shared confidential information about client orders prior to the fix, and then used this information to attempt to manipulate the fix downwards.

The sterling/dollar exchange rate fix fell from £1.6044 to £1.6009 in this particular example, making HSBC a $162,000 profit.

Afterwards, traders congratulated themselves, saying: “Loved that mate… worked lovely… pity we couldn’t get it below the 00”, “there you go.. go early, move it, hold it, push it”, “nice works gents..I don my hat” and “Hooray nice teamwork”.

In another example, the FCA said Citi traders had attempted to drive the euro/dollar fix upwards by sharing information on its buy orders with traders at other firms.

Traders at these firms then transferred their buy orders to Citi, giving it more influence on the market

Ultimately, the euro/dollar fix rose and Citi’s profit for the trade reached $99,000.

After the trade was completed, traders shared congratulatory messages such as “lovely”, “yeah worked ok” and “cn’t teach that”.

Who gets hurt?

The price movements arising from the manipulation are so small that holidaymakers are unlikely to notice a big difference when buying foreign currency.

The biggest losers are companies found guilty of manipulation. Even for big banks £2bn is a lot of money.

The regulators say that some of the banks’ clients could have suffered from the market being skewed. That could affect the value of pension funds and investments.

This kind of manipulation also further undermines trust in the financial system, which has been through a series of scandals.

For more information use this link:-

http://www.bbc.com/news/business-26526905

Leave A Response

You must be logged in to post a comment.